Before I get into this, I launched a podcast.

It is sponsored by Northbeam.

I made a big deal in the past about how annoying sponsorships are in the space, and this newsletter will remain an unsponsored space. But I am sorry to whoever I clowned on in the past lol

Here is why the show is sponsored:

I want to pay guests who come on

Guests spend time doing the show and I believe people should be paid for their time

The show came to me with northbeam attached

I wanted to do a podcast for a long time, but I can’t get my shit together to do it. Doing this newsletter is already enough to me

So Finn, the producer, does all the work and I show up to recorded

He set the whole thing up and brought northbeam in before me

Lastly, Ridge has used northbeam since 2019

Before first party attribution was a thing

We were the first customer and Connor my CMO advised them since the early days

Having northbeam set up let us not miss a beat when iOS 14 hit

If you spend more than 1m a month, a tool like northbeam is necessary.

But until you get to 8 figure in spend, just spend that money on facebook.

It’s like mixed media modeling, you only need it when you spend a lot of money a lot of places.

Otherwise the dashboard is just going to be an expensive facebook UI lol

The podcast is very good. And I am thankful to Finn, Northbeam, Mike, Matt, and Jason for letting me be a part of it.

The first episode is out. It is a little rough, but we are finding our footing. By episode 5 we will be WAY better than all those other dorky DTC podcasts ;)

Jason, Matt, and Mike are all inspirations. I have a lot to learn from each of them.

The world would be a better place if more leaders were as open and honest as those three.

WHY PAYING TAXES SUCKS

I actually don’t care about paying personal taxes.

Removing politics out of the conversation, trying to optimize income tax burden feels like a low TAM game.

Just make more money.

Yes- I left LA to move to TX, but saving the 10% per year in income tax was far down my list.

Higher on my list was:

I lived in a shitty $4,000 a month apartment

My apartment building was broken into weekly and all the bikes kept getting stolen

My friends and family all moved away

There weren’t builders in LA anymore

The energy of starting new shit seemed to have left, so I left

So who cares about personal income tax. That’s your choice really.

BUT BUSINESS TAX IS BRUTAL.

Two main buckets here:

Sales tax

No one does this right. You are currently not doing it right.

How do I know? I spent $500,000 over the past 12 months to get my shit perfect.

That is the one time set up fee to be perfect since the Wayflyer ruling

On top of the $500,000 in audits, legal work, referrals and sign offs, there is an ongoing management fee of $60,000-$100,000 a year.

No one cares about this. Politicians wont help you. This is layers of bad judicial rulings, local governments looking for free money, and a system designed to hurt small online businesses.

At any point, any state can come looking into your business and demand money you didn’t collect.

I know because this happened to us.

And that’s why I spent the $500,000 to make sure it can’t happen again lol

But outside of my hate for online sales tax, there is another tax quirk I dislike.

Cash to accrual account

In our first podcast episode, I talked about the time Ridge almost went out of business.

It was because of Accural accounting.

I am not a CPA, but even CPAs are pretty fucking stupid on this topic. Ask 3, get 3 different answers. But to summarize:

Cash based accounting is the simplistic form of accounting, used for small businesses

Money in, money out, what’s left is profit

But- at a certain point, the IRS makes you switch to Accural accounting

The point when you have to is confusing and debated

But the IRS says “it shows a better true health of the business”

In reality, you can’t hide profit using Accural accounting

In cash accounting, on 12/31 just make a huge purchase

Bam zero profit

In Accural accounting, you have to recognize all accounts receivable as income, but you also can’t write off inventory until it is sold

It’s Cost of goods SOLD, inventory is an asset until it is off the books

You are trading cash for inventory 1:1, so it isn’t an expense

How does this play out in real life and how can it make you almost go out of business?

This are fake numbers, rounded to whatever, because I don’t actually remember all the details.

Ridge is a profitable business.

We were growing 2x YOY for several years.

We switch to accural accounting because we have too.

We show 5m in net income off of 20m in revenue

We owe 2.5m in taxes, and last year we spent 5m on COGS

But sales are doubling, if we want to keep growing we need 2x as much money for inventory

That becomes 10m in inventory, 2.5m a quarter

So we have two things competing for the same amount of money:

Do you pay taxes? Or do you buy double the inventory as last year?

We paid the taxes.

We took a hit to growth to have a transitionary year.

Lost a ton of momentum. We were broke as hell for a year. All because the tax code feels designed to punish high growth physical product companies.

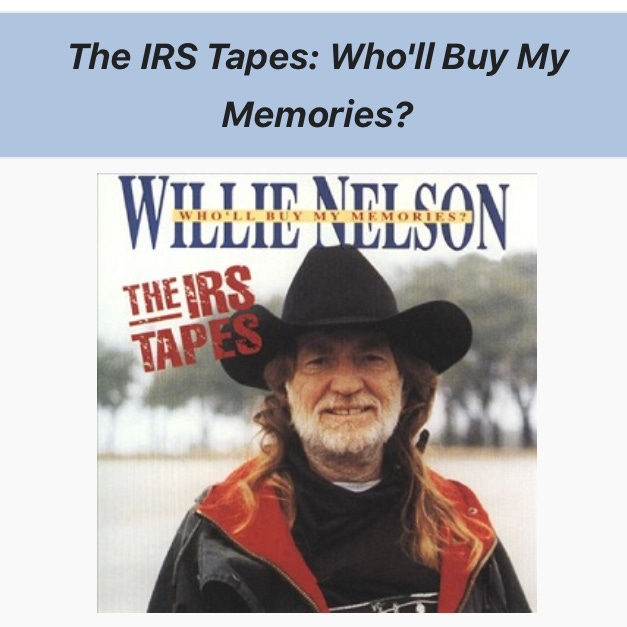

What does this have to do with Willie Nelson?

In the 90s, after a 40 year career, the IRS came to Willie Nelson and said “you owe us 16 million dollars”

His accountants, PWC a big 4 firm, never paid his taxes.

Willie was going to go to jail.

He put out the IRS tapes, a new recording with all proceeds going to the IRS. He had to market the hell out of it for years to pay off his taxes. TV spots, tours, etc.

Lessons:

This is your job to understand. Don’t trust who you outsource work too

This isn’t google ads, fucking up your taxes could put you in jail

We don’t want to make an IRS wallet

We made sure we paid the government first, every time

Physical product companies aren’t designed to double ever year

Literally the US government doesn’t want you too